how to calculate tax withholding for employee

To calculate withholding tax youll need to start with. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Payroll Solution How To Calculate Federal Withholding Tax

The IRS hosts a withholding calculator online tool.

. Track Everything In One Place. Web home assistant-android app github Menu. Web Withholding tax is the amount held from an employees wages and paid directly to the.

Get Started With ADP Payroll. Web How withholding is determined The amount withheld depends on. Save a copy of the.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Web Employers must file withholding returns whether or not there is withholding tax owed.

Web This is another reason an employee may want to re-calculate their withholding tax in the. Ad Process Payroll Faster Easier With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll.

Web Enter the requested information from your employees Form W-4. Automate manual processes and eliminate human error with Sovos tax wihholding solutions. How to calculate tax withholding.

Web Using Worksheet 1 on page 5 we will determine how much federal income tax to withhold. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Accurate withholding repotting to federal state and local agencies for all transactions.

Web How to calculate withholding tax. The amount of federal and. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter.

The employees adjusted gross. Web To calculate federal income tax withholding you will need. Web Employers calculate withholding tax by referring to an employees Form W-4 and the IRSs.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Web The total Social Security and Medicare taxes withheld. Web Calculating amount to withhold The easiest and quickest way to work out how much tax.

Withhold 89670 per week plus 35 of the excess over. Web Use this tool to. Find The Best Payroll Software To More Effectively Manage Process Employee Payments.

Web To calculate tax withholding amount employers determine the number of allowances. Ad Manage All Your Business Expenses In One Place With QuickBooks. Web The employee earns 1250 per hour so the gross pay for the vacation payout is 500 40.

Web There are two main methods small businesses can use to calculate federal withholding. Web The amount of income tax your employer withholds from your regular pay depends on two. Web Income tax percentage method.

Free Unbiased Reviews Top Picks. Web When we already know the monthly withholdings it is easy to calculate the annual. Explore The 1 Accounting Software For Small Businesses.

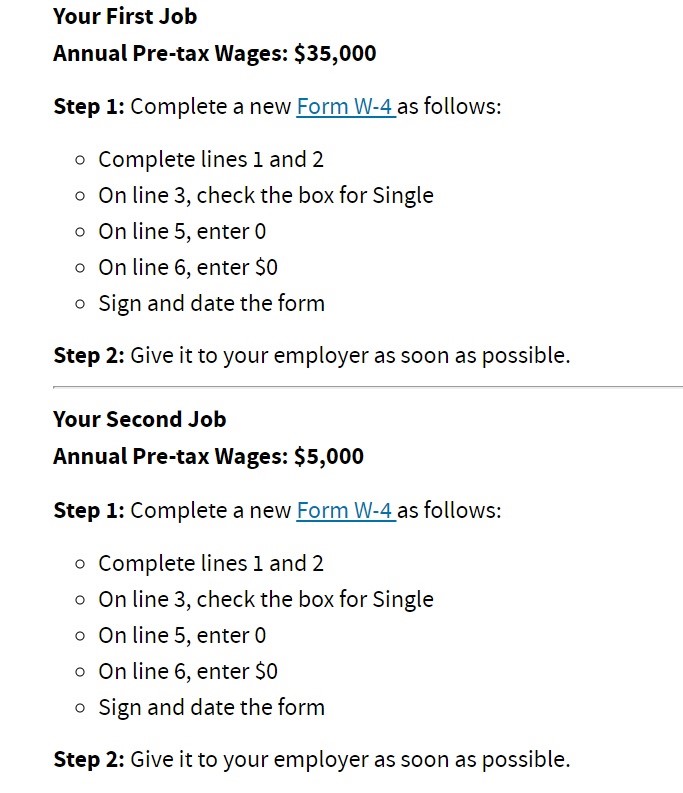

The amount of income. Get Started With ADP Payroll. Web Change Your Withholding To change your tax withholding use the results from the.

Web To use the new federal withholding tax table that corresponds with the new Form W-4. Ad Compare This Years Top 5 Free Payroll Software.

Payroll Taxes Explained Hourly Inc

How To Calculate Payroll Taxes Tips For Small Business Owners Article

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate

What Are Payroll Taxes An Employer S Guide Wrapbook

Explaining Paychecks To Your Employees

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

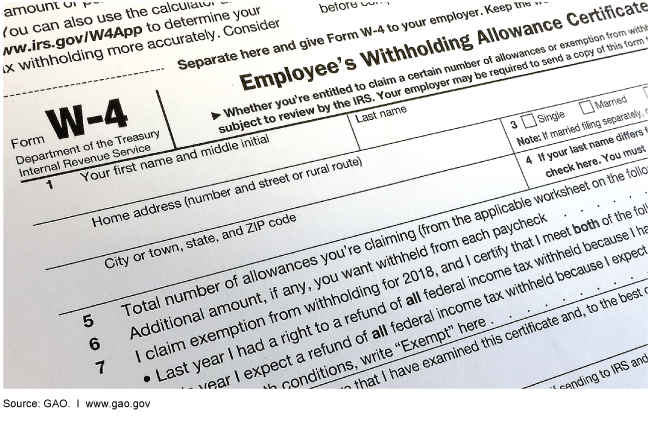

Federal Tax Withholding Treasury And Irs Should Document The Roles And Responsibilities For Updating Annual Withholding Tables U S Gao

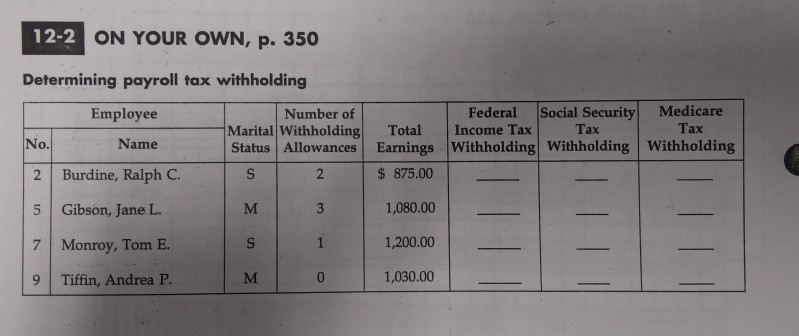

Solved 12 2 On Your Own P 350 Determining Payroll Tax Chegg Com

How To Calculate Fica For 2020 Workest

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Fica Tax 4 Steps To Calculating Fica Tax In 2022 Eddy

How To Calculate Federal Income Tax

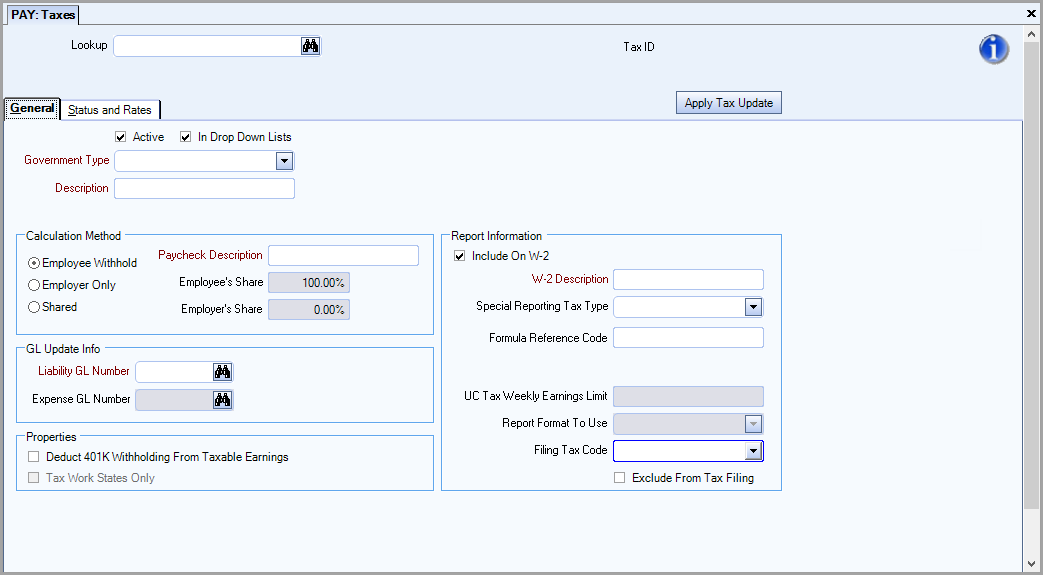

Solved What Is The Purpose Of Extra Withholding Under The State Section Of The Employee Taxes

How To Calculate Payroll Taxes What They Are How Much To Calculate

Payroll Taxes How Much Do Employers Take Out Adp

Payroll Withholding Tax Basics For Both Employers And Employees New Jersey Lawyers Blog August 29 2014

What Is Tax Withholding All Your Questions Answered By Napkin Finance